Beautiful pre-Christmas day, dear friends and clients,

elebrational and motivational Christmas wishes would be difficult and inappropriate to write after the tragedy on Palach Square, so I will not even try. ![]() Yet (and maybe more), it is necessary to appreciate what we have. I want to wish you all a beautiful Christmas, a peaceful and relaxing holiday in the circle of your loved ones, and not only a successful entry into the New Year but the whole year mainly of GOOD HEALTH, satisfaction, and positive energy so that we enjoy life, family, and work (even in times when it is not all going smooth and sometimes even terrible things are happening). I believe that by spreading positive energy, inspiring others, enjoying life, and helping people who need it, we will contribute every little bit to make the world a little better. This tragedy showed us the other side of life so we can appreciate the positive side and fight for it. Let’s honor the tragedy victims and their families (we can also contribute here: https://www.darujme.cz/

Yet (and maybe more), it is necessary to appreciate what we have. I want to wish you all a beautiful Christmas, a peaceful and relaxing holiday in the circle of your loved ones, and not only a successful entry into the New Year but the whole year mainly of GOOD HEALTH, satisfaction, and positive energy so that we enjoy life, family, and work (even in times when it is not all going smooth and sometimes even terrible things are happening). I believe that by spreading positive energy, inspiring others, enjoying life, and helping people who need it, we will contribute every little bit to make the world a little better. This tragedy showed us the other side of life so we can appreciate the positive side and fight for it. Let’s honor the tragedy victims and their families (we can also contribute here: https://www.darujme.cz/

Now let’s go to see what happened in the markets.

In November, shares grew again, this time significantly. World shares (measured in CZK) grew by 4.9 %, and stocks, bonds, and gold increased. Shares are at their maximum. Over the last three years, they were rarely higher. The asset value growth is due to investors’ expectations of a decline in interest rates. Inflation worldwide (USA, Europe, and the Czech Republic) is decreasing, so banks will not have to increase interest rates further, but they are talking about their reduction. Lower rates help the economy’s growth, stock prices, and bond prices.

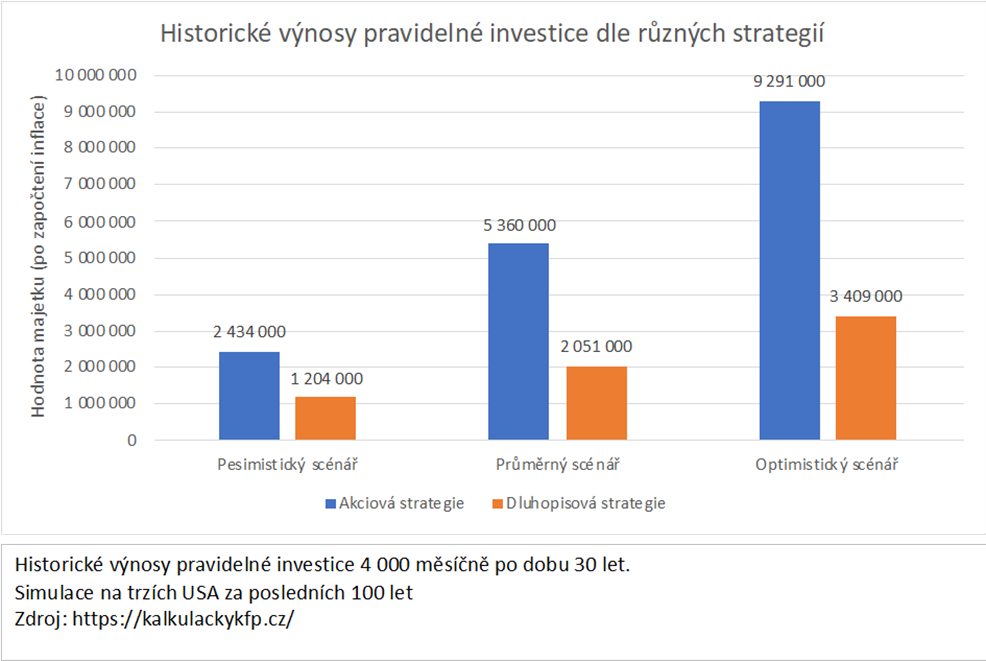

In November, the Chamber of Deputies passed a law that expands and complements the possibilities of savings for old age, the so-called “Long-term investment product” (in Czech, “Dlouhodobý investiční produkt“ or DIP). It is briefly said that tax savings will be possible for Supplemental pension plans (in Czech DPS), life insurance, and other products. Moreover, the limits for tax savings should significantly increase. The law has not yet come into force, we are waiting for approval by the Senate and the President’s signature. However, I want to inform you in advance because after the law is approved, the wave of intensive information campaigns will be pulled off by the product’s creators, sellers, and media. If you are interested in the product, do not be blinded by the vision of the tax savings! It is necessary to consider whether the product is suitable for you carefully and in what version. The choice of investment strategy, the so-called strategic allocation, is far more important than tax savings! It is even more important than the amount of entry fees or the cost of funds. The graph below compares the investment in bonds and purely in shares. It can be seen that by choosing an incorrect strategy, the client can lose millions. Compared to the maximum tax savings in DIP (CZK 216,000 for 30 years of savings), this is an incomparably more significant loss/profit.

V.I.P. Senior Consultant VII

Partners Financial Services, a.s.

Nové sady 2, 6.p.

602 00 Brno