Important Update: Changes in Real Estate Tax and Year-End Investment Insights 🏡💼

Dear friends and clients,

With the new year’s arrival, I wish you all good health, work and personal success, and happy moments you will remember with love.

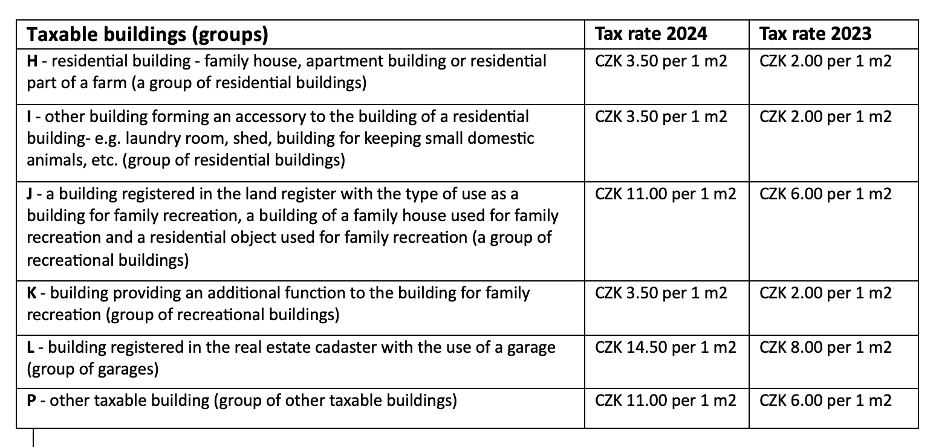

In today’s email, I want to inform you about changes in the tax on real estate property that are already in effect. Let’s look at it. It’s called a real estate tax, and it is unique among Czech taxes in that it is paid in advance. The deadline for submitting a tax return for property tax is January 31, 2024; property tax must be paid by the end of May or in two installments by the end of May and November. The real estate tax form is filled in only once a year after the acquisition of the real estate; in other years, the tax office only assesses the tax. A real estate tax return is re-submitted when the circumstances affecting the tax calculation change. This year, however, an exception awaits owners of some properties: they will have to submit a tax return even if nothing has changed. Newly, for taxation purposes, it will be decisive how the building is registered in the real estate cadaster, not for what purpose it is used. The property tax rate will increase by approximately 80% from January 2024.

How do you fill out a real estate tax return? The Financial Administration recommends filing the real estate tax return electronically via the Electronic Filing for the Financial Administration (EPO) application on the mojedane.cz website. If you need help with the tax return, contact a tax advisor or accountant (or me; I will send you a contact).

We are behind in the year 2023. What did it bring in terms of investments?

We entered 2023 with high inflation, which the central banks tried to suppress with high-interest rates. There was uncertainty in the market about whether the treatment of inflation would be managed and whether high-interest rates would not dampen the economy, which could fall into recession.

At the end of 2023, inflation started to decline, and it looks like the treatment of high inflation was successful. (At least for now.) That’s why central banks are starting to cut interest rates and intend to continue in 2024.

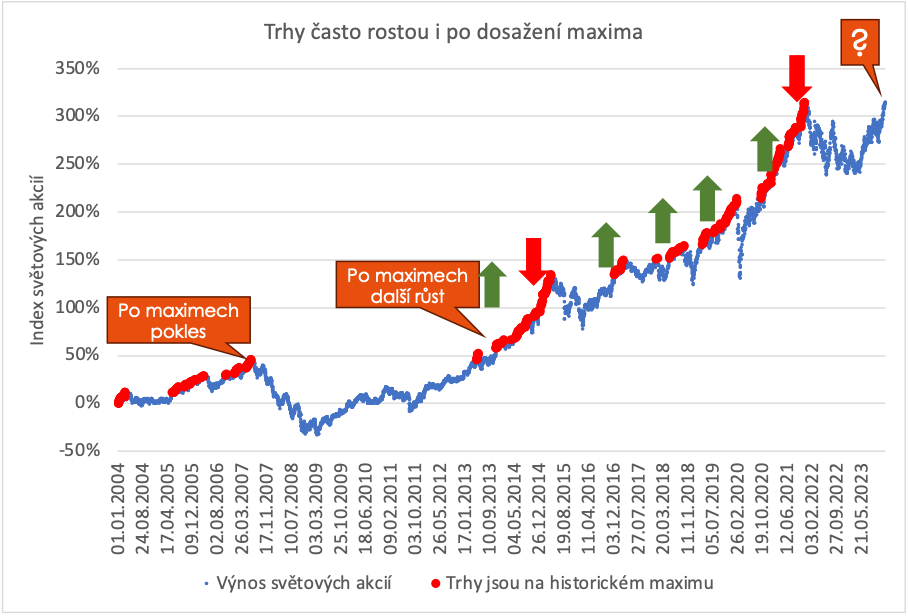

Stock markets have had a successful year and are growing. World stocks rose 21.5%. Thus, they erased the losses from 2022 and got close to their historical highs. We haven’t seen stock markets at their highs for 2 years. However, market peaks are nothing special. In the past, this happened quite often. After reaching historical highs, markets behave much like they do in regular times. Furthermore, they can grow and fall, mostly in long-term growth. Have you ever heard someone say, “The markets are too high; they have to fall! I’ll wait for a drop and then start investing.” Such a strategy is wrong and dysfunctional. You can’t time the market :).

The chart shows that the stock markets mostly continued to grow after reaching their maximum. Mostly, but not always. Of course, they can go either way.

We do not invest in stocks based on whether they are at their peak but on whether we need them in the portfolio. This comes from the financial plan and the long-term strategy.

If you need help setting up a strategy, don’t hesitate to contact me.

V.I.P. Senior Consultant VII

Partners Financial Services, a.s.

Nové sady 2, 6.p.

602 00 Brno